When it comes to funding a startup, the options can be overwhelming. From traditional bank loans to venture capital, there are a variety of options for entrepreneurs to explore. But for those looking for more flexible and tailored options especially in these difficult times, alternative sources of funding may be the best route. This blog provides a comprehensive guide to alternative funding sources.

In times with rising interest rates, harder economic circumstances, bank funding or venture capital may be more difficult to attract. It is also necessary to prepare for a longer period of lower cash-flows due to lower economic activity. For extending the runway, and to secure the continuity, even in difficult times, different sources of funding can be considered. These alternatives ways for funding can be useful for startups because they provide access to capital without having to rely on traditional financing sources. Alternatives to traditional financing include grants, crowdfunding, bootstrapping, and revenue-based financing. These sources provide entrepreneurs with access to capital without having to go through the often time-consuming and complex process of getting approval from banks and investors. Additionally, these alternative sources may provide more flexible repayment terms and often lower interest rates, which can be beneficial for a startup.

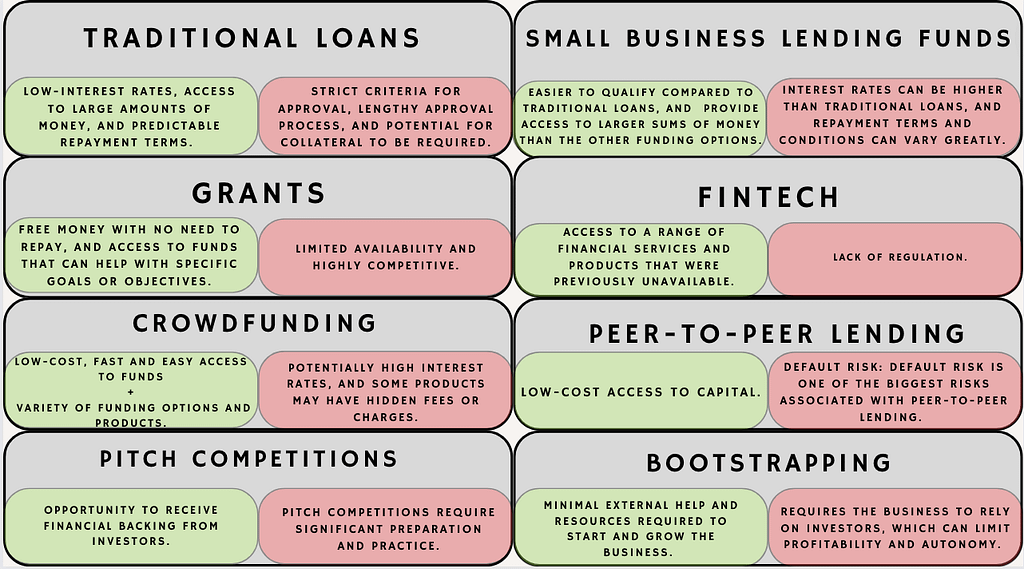

We’ll take you through the different alternative funding sources available to startups. It may be that one of those will fit the expectations your company was looking for!

Traditional loans

Traditional loans are a form of borrowing money from a lender, such as a bank or credit union, in exchange for a promise to repay the loan with interest over a predetermined period of time. Traditional loans may be secured or unsecured, depending on the borrower’s credit and the terms of the loan. They can be used for a variety of purposes, including purchasing a home, financing a business, or consolidating debt.

Pros: Relative Low-interest rates, access to large amounts of money, and predictable repayment terms.

Cons: Strict criteria for approval which include having a strong view on profitability, positive net equity and subordination. The process often has lengthy approval process, and potential for collateral to be required.

Small Business Lending Funds

Small Business Lending Funds (SBLF) are a type of government-sponsored funding program designed to provide capital to small businesses in the form of low-interest loans. The loans are provided by financial institutions that have been certified by the U.S. Treasury Department. The funds are meant to help businesses expand and create jobs, as well as provide access to capital for businesses in underserved markets. The SBLF program also offers technical assistance to businesses seeking to expand or startup operations.

Pros: Can be easier to qualify for compared to traditional loans, and can provide access to larger sums of money than other funding options.

Cons: Interest rates can be higher than traditional loans, and repayment terms and conditions can vary greatly.

Grants

Grants are funding options in which a government or other organization provides money to an individual or group, usually with no obligation to repay the money. Grants are typically used to fund projects or initiatives that have a public benefit. Grants are often competitive and require applicants to submit a proposal outlining the project, its objectives, and how the money will be used.

Pros: Money given by the gouvernement in some rare cases with no need to repay, and access to funds that can help with specific goals or objectives often funds can be borrowed at extremely low rates.

Cons: Limited availability and highly competitive with often additional reporting requirements and paperwork.

Revenue based financing

Revenue based financing (RBF) is a type of financing that is based on a company’s revenue. RBF is typically provided by alternative lenders, such as venture debt funds, and is different from traditional debt financing in that it does not require collateral to be provided.

The investors get a fixed percentage of ongoing gross revenues, with payment fluctuations based on business revenues, typically measured as monthly revenue. RBF offers more flexible terms than traditional debt financing, with no fixed repayment terms or interest rate. This can make it easier for growing companies to manage their debt.

Pro: Quick financing: RBF can provide financing quickly, as it does not require extensive due diligence or collateral.

Cons: RBF is riskier for investors than traditional debt financing, as lenders have no way to recoup their capital if the company fails to generate the expected revenue.

Crowdfunding

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. This type of funding is typically done through online platforms that allow people to donate money to a cause or project some well known platforms are Winwinner, Patreon, Indiegogo, Ulule and Kickstarter. The funds are generally collected in the form of donations, either as a one-time payment or as a periodic contribution. Crowdfunding can be used to fund a variety of projects, from startups and businesses to nonprofit organizations.

Pros: Fast and easy access to funds, and access to a variety of funding options and products.

Cons: Potentially high interest rates, and some products may have hidden fees or charges.

Peer-to-Peer Lending

Peer-to-Peer Lending is a type of funding in which individuals can lend and borrow money directly from each other, without the need for a bank or other traditional financial institution. This type of funding allows borrowers to access funds at lower interest rates than what they would normally receive from a bank. Also Lenders could earn higher returns on their investments than they would from traditional investments.

Getting P2P investing is not as easy as it may seem the difficulty is finding the right individuals. This can be an acquaintance like family or friends, or investor in which case you have to search direct contact. You can network with investors by reaching out to those who have a track record of investing in startups and has the financial resources. Using crowdfunding platforms can also create direct contact for funding.

Pros: Low-cost access to capital,

Bootstrapping

Bootstrapping is a type of funding where a business or venture is started and operated with minimal external help and resources. It involves using existing resources, such as money from savings or from family and friends, to start and grow the business. Bootstrapping typically requires the owner to be very resourceful and self-reliant. This type of funding is often used by entrepreneurs who are looking to start a business with a limited budget. Funding is needed for a business to grow, however natural growth curve is often superior to an abrupt and rapid growth. Therefore raising less money can often be a strategic move so companies can slow down the growth.

Pros: Minimal external aid

Cons: Possibility of losing autonomy

Overview funding alternatives

Pitfall

The most common mistake that leads to bankruptcy is taking on too much debt. This can be a result of overextending credit, borrowing more money than can be reasonably repaid, or failing to properly budget and manage expenses. Finally, underestimating the amount of money that will be needed can also lead to financial distress and bankruptcy.

CFORENT ADVICE

Attract the right financing mix at all times to diversify risk and set clear priorities in which source of financing is taken on for which reason. It is important to make educated decisions about which sources to take on for which reasons and at what stage in the company’s growth. A solid financing mix consists in most cases of multiple sources from different capital providers. It is key to attract them at the right moment, with the approriate storyline.

FUNFACT

Theranos, a Silicon Valley healthcare company, made a series A funding mistake that ultimately led to its bankruptcy. Theranos raised $6 million in Series A funding, but instead of investing in their technology and product, they spent it on hiring and marketing. This left them unable to demonstrate the value of their technology to potential investors. As a result, Theranos was unable to secure the necessary capital to grow, leading to its eventual bankruptcy.

Talk to the experts

How do your profitability metrics measure up to your industry’s norms? And is there a way to improve your results to increase your profit margins? Contact CFOrent for expert help and insights on measuring, monitoring, and improving your profitability metrics to take your company to the next level.