In the dynamic world of business, CEOs, CFOs, entrepreneurs continually face the challenge of elevating their company’s value. The core question persists: How can you significantly enhance your company’s valuation without resorting to extended hours or increased workload?

Supercharging the value of your company

Understanding and leveraging key financial strategies is pivotal. This guide delves into crucial concepts such as Return On Capital Employed (ROCE), Weighted Average Cost of Capital (WACC), and the strategic use of financial leverage. These insights aim to empower you with effective tactics for boosting your company’s valuation, setting a solid foundation for successful negotiations, whether in investment scenarios or during the crucial moments of a sale.

Let’s jump straight to it and take it to the next level with an example as a guideline.

Return on capital employed (ROCE)

ROCE is a critical profitability ratio that evaluates how efficiently a company uses its capital. It compares how much your company earns with how much you invested to generate these returns. Needless to say, you want the earnings to be as high as possible with as little invested capital as possible. Mature companies generally strive for 20% (sector-dependent). In the start-up/scale-up phase, it’s important that the trend is positively growing.

Let’s illustrate with an example:

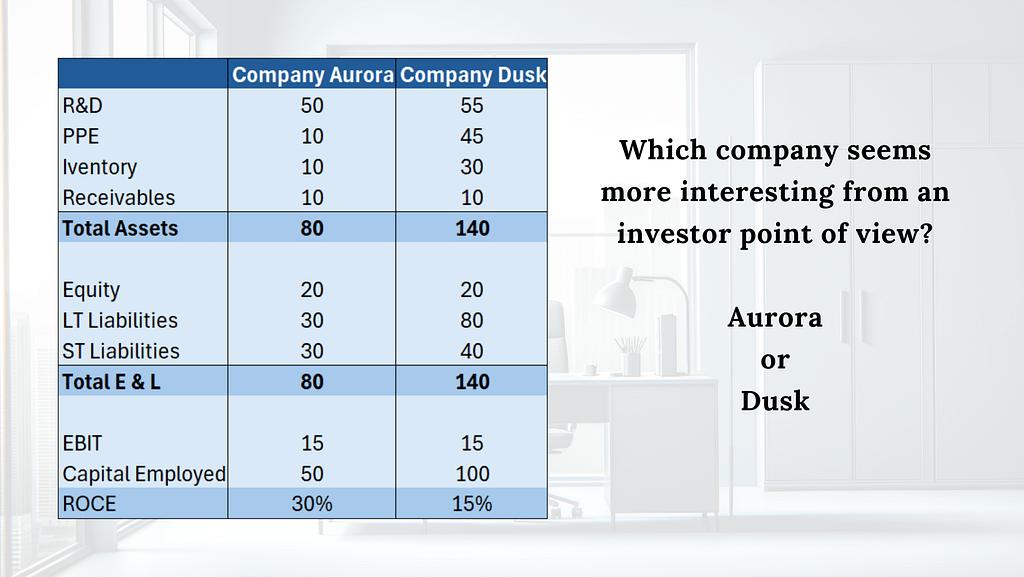

Company Aurora is a software scale-up. It has mainly invested in product development.

Company Dusk is a scale-up that produces its own hardware and adds a software layer on top. This company has invested in product development, machinery, and a sufficient level of working capital to keep the production going.

Capital employed is calculated as total assets minus current liabilities.

The earnings before interest and tax (EBIT) divided by capital employed equals ROCE.

The earnings of Aurora and Dusk are the same. From an investor’s point of view, which company seems more interesting?

Company Aurora only needs to employ 50 in capital to reach an EBIT of 15, while company Dusk has to double its capital employed. In other words, Dusk needs to double its result to be as efficient as Aurora. Needless to say, Aurora utilizes its capital much more efficiently than Dusk. Fortunately, we can work on this!

How can we boost your ROCE?

So how can we boost your ROCE and help you use your hard-earned cash as efficiently and effectively as possible? There are two options: increase your earnings or decrease your funds needed for these earnings. As every business is different, we will skip the earnings (you will probably know best for your business) and focus on some tips and tricks to decrease your capital employed:

- Thorough Investment Analysis

Implement a comprehensive investment analysis process that rigorously evaluates proposed projects based on their potential return on investment (ROI). Assess not only the immediate financial impact but also the long-term benefits and risks. Prioritize projects that align with your strategic objectives and offer the highest ROI. For example, if Company Dusk needs to close the gap with Aurora, which choice would you prefer?

The preferred choice could be to invest in R&D, as this provides a sustainable competitive advantage, is tied to our strategy, mitigatable risks, and has a large ROI. Either way, a business case approach provides the management with sufficient parameters to fuel discussions and make rational argument-backed decisions. - Avoid Overinvestment

It’s crucial to strike a balance between necessary upgrades and overinvestment. Overly ambitious projects that do not align with your core business objectives can tie up capital that might be better utilized elsewhere. For example, a large branding campaign may not be the preferred choice when your product encounters a critical malfunction. Focus initially on projects that directly contribute to revenue growth and cost reduction. - Regular Monitoring and Reporting

Implement a system for monitoring and reporting on the performance of capital investments. Set clear key performance-indicators (KPIs) and regularly evaluate whether projects are meeting their financial and strategic objectives. Adjust or terminate projects that underperform. For example, sell the underperforming asset and repay the highest interest debts or reinvest the proceeds in projects with a higher ROI. - Review Lease versus Buy Decisions

When considering new assets, carefully assess whether leasing or purchasing is the more cost-effective option. Leasing can provide flexibility and cost savings, especially when technology or equipment quickly becomes obsolete. Furthermore, leasing allows you to access the necessary assets without a significant upfront capital outlay. - Working Capital Management

By keeping your working capital in check to fuel your business without being a cash glutton, you reduce the capital employed. If your clients pay upfront or in cash, you have limited inventory and can negotiate long payment terms; it’s even possible your working capital is negative, and your suppliers provide (the cheapest) credit for your operations.

Incorporating the above strategies into your capital investment process can help reduce unnecessary spending and free up capital for projects that generate higher returns.

Stay tuned for part 2, where we will explore the impact of financing on your company’s valuation!

Would you like to have an expert take a look at your specific situation? Don’t hesitate to reach out!