As startups and fast-growing companies navigate the ever-changing business landscape, effective management reporting is becoming increasingly vital. This blog explores the key components of management reporting and why it’s essential for both fast-growing and dynamic companies.

Companies rely increasingly on management reporting to improve their business operations and to stay one step ahead of their competitors. What is management reporting? And is it a must or just a report to keep investors happy?

Good management reporting for starting and scaling companies should provide clear and concise information that helps the management team itself make informed decisions and track the progress of the business. This information cannot only be linked to financial statements, but should inform on the progress of strategic initiatives, team and talent, but also new product launches and even information on competitors their evolvement or the market in general.

What is management reporting?

Management reporting is a form of business intelligence. A management report collects data and information on various business aspects and organizes them into a clear overview. This overview should provide answers to questions such as:

- Is it a good idea to hire more employees? Which skills or expertise contribute to the success of the business?

- Which customers generate most profit? Which of our products offers the biggest contribution margin?

- Should we increase our marketing efforts? If so, via which channel?

- Which core KPI’s are directly related to your business rationale? This can include metrics like market share, customer acquisition, customer lifetime value.

- A clear management report, gives insights that are easy to interpret and understand and makes it easier for decision-makers to make decisions with more impact.

It is of crucial importance that the management report should focus on the elements that make a decisive difference for the company in the competitive environment. It is for example not a good idea to dive too deep in a 1% margin difference for a advertising agency, whereas it might be a crucial element to drill-down this 1% difference when talking about a scaling pet food company.

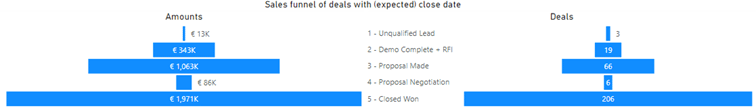

Figure: An in-depth overview of the sales funnel can give insights in where your efforts are effective and where they are not.How does management reporting work?

Management reporting collects data on the various departments of your company. Reporting is based on financial and operational data points, accompanied by the necessary comments, if relevant. It gives you a clear picture of your company’s health over a given period. Management reporting often works with KPIs. If they are not achieved (when comparing to your budget (BUD) or targets (TAR) or prior year (PY)), you should immediately know where to adjust.

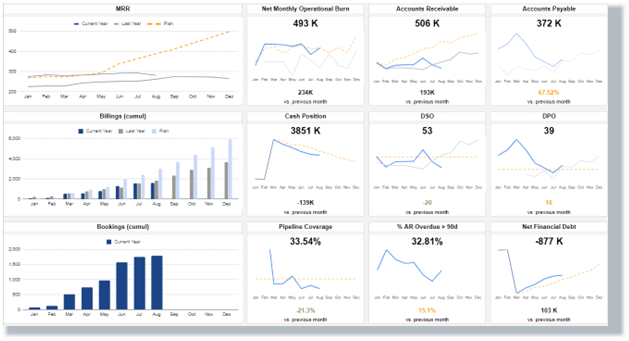

Figure: Example of a key overview focusing on financial and sales metrics for a SaaS business.What’s the point of management reporting?

Professional management reporting software provides a detailed overview of how your company is performing on the aspects that matter most. It ensures you are making the right decisions and you are not having to chase after the facts. This means:

- More efficient operational processes and business management.

- You can monitor the progress and understand the progress.

- Your company remains a formidable competitor.

- You are steadily and consciously working on improving your business.

Figure: Understanding the root cause of certain metrics can help to make insights actionable and can help having the entire management chasing the same objectives. It also creates the understanding that decisions in one department often have an impact on others.What’s the difference between a financial and a management report?

Management reports and financial reports are sometimes mixed up. But there is a big difference:

Your company keeps financial reports for accounting purposes and specific financial purposes. They provide an overview of your company’s performance in terms of P&L, Balance Sheet, Cashflow, specific metrics, but are not in-depth enough to make effective adjustments or adjust decisions upon.

Management reporting is up-to-date and combines not only financial, but also operational (logistic, people, sales, …) data. This means it’s easier to make adjustments on time and within specific departments and to monitor your company’s progress.

Figure: Example on a short term metric (billability) being depicted in a management report for a marketing agency.How do I start with management reporting?

Management reporting provides a quick, in-depth health check of your company and should help you, as entrepreneur, to be more efficient in decision-making. Creating a management report is often a time-consuming process, but should always add value.

A CFO tip is to see the creation of the management report as an iterative and evolving process. Start with the data and information points that are available and iterate from that point. You will often see that based on the questions raised in the management report, you will evolve toward the report/dashboard that the company needs at that specific moment. Be aware that depending on your growth trajectory or maturity different focusses will be needed.

It’s essential if you intend to use the report to quickly and clearly inform all decision-makers in your company. The choice of the used KPIs can be a real headache: too many causes confusion and stands in the way of a quick overview. Too little and you might miss important insights. In future blogs, we will dive deeper into KPI’s as a decision tool.

If you want to get most out of your reports, you need to get the structure of the data and report very clear. Overlooking the fact that you need to thoroughly understand where the data points or information is coming from. This to make sure that you are actually looking at the right trigger point or business rationale.

Figure: The waterfall chart; often extremely useful to make it insightful and make it understandable how a certain value has been affected by a series of events.If you need assistance aligning your management report with your business and users, please don’t hesitate to get in touch with us.