In the dynamic landscape of the Belgian finance, but broader also the European, securing a loan involves navigating through a maze of regulations, negotiations, and financial obstacles. In our experience, the general perception today is that acquiring a loan seems more difficult, takes longer and comes with more and more conditions in order to get approval. Whether it’s for business expansion or to increase liquidity, understanding the fundamentals of a loan agreement is crucial for entrepeneurs looking to take their business to the next level. This article aims to highlight two key aspects of loan agreements: covenants and collateral.

Securing favourable terms and conditions is of great importance for your business when aiming to gain more autonomy and more flexibility to succeed your business as you intended to. In our previous article, we highlighted the impact of interest rates on your business. Today, we dive deeper in these less-known features of a loan and find out whether our perception of more strict conditions on loan agreements matches the feedback given, by banks, in the Bank Lending Survey (BLS) conducted by the European Central Bank.

Key Take-aways

- Understand your financial and operational limitations and offerings when dealing with the bank.

- The overall trend for covenants and collateral mirrors the general perception of economic stability.

- Negotiating is crucial, especially given the current strictness of banks.

The Bank Lending Survey

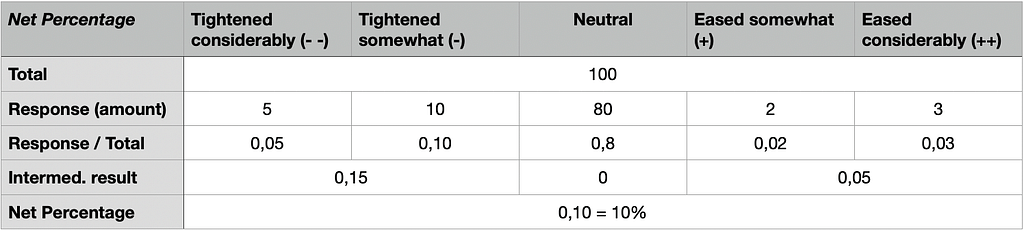

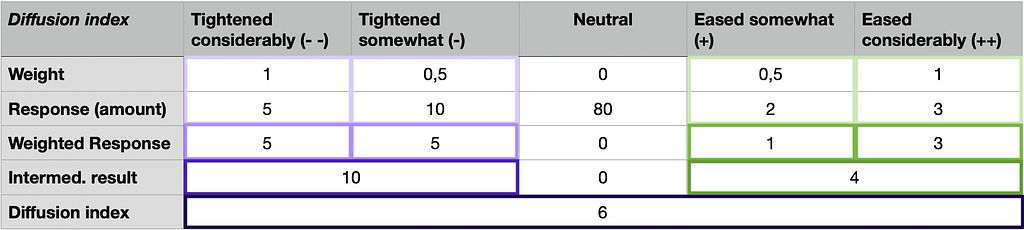

Each quarter, the European Central Bank holds a questionnaire among European banks and compares the results with the previous quarter. The questions are qualitative and range from “having tightened/increased considerably” and “somewhat tightened/increased” to “somewhat eased/decreased” and “having eased/decreased considerably”. The responses are converted in numbers by means of a diffusion index and a net percentage.

- Diffusion index (DINX) is the difference between the weighted sum of positive responses vs. negative responses.

- Net percentage (FNET) is the difference between the sum of positive responses vs. negative responses, in percentages.

The net percentage depicts an absolute difference between positive and negative responses. The diffusion index is a more nuanced indication because it adds weights of 0.5 and 1 to the responses “somewhat” and “considerably”.

The findings of the Bank Lending Survey are subject to the banks’ perspectives and may not necessarily reflect how the general public perceives these conditions. More info can be found in the ECB Glossary.

Take Control over Covenants

Covenants are additional conditions of a loan agreement. They outline the terms and conditions under which a borrower must operate during the loan duration. These conditions serve to protect the lender’s interests by mitigating risks associated with default or financial instability. Covenants can be broadly categorised into positive covenants and negative covenants, and qualitative and quantitative covenants

Positive covenants require the borrower to fulfill certain actions or meet specific financial targets. Concrete examples are:

- Meeting a certain solvency ratio, which is quantitative.

- Minimum Net worth, which can be equity minus intangible assets, which is quantitative.

- Submission of the annual reports to the bank, which is qualitative.

On the other hand, negative covenants restrict a borrower from taking certain actions that could jeopardise the lender’s position. These may include limitations on additional borrowing, restrictions on asset sales, or constraints on dividend payments. Concrete examples are:

- Negative pledge clause, which prohibits your business from providing stronger collateral to a third-party. It’s qualitative.

- The cross-default clause, which gives the lender the right to suspend all loans with the business if one covenant is not fulfilled. It’s also qualitative.

It’s essential for borrowers to thoroughly review and understand covenant requirements before agreeing to a loan. Failure to meet covenant obligations can trigger penalties, such as increased interest rates, higher collateral or termination of contract. Thus jeopardising the financial health of your business. Small business owners should therefore carefully assess their ability to comply with covenant terms before entering into a loan agreement.

*CFO-tip*: Covenants are negotiable. If you do not agree with certain covenants, negotiate other terms. Think win-win; the bank will be more inclined to accept your counteroffer if they feel you are being reasonable.

Summary Covenants Data

The overall pattern in the data indicates that Belgian banks have shifted from easing covenant conditions to tightening them since mid-2019. This adjustment appears to align with broader economic trends influenced by factors such as COVID-19 and rising interest rates. Interestingly, Belgian banks relaxed covenant requirements for large enterprises in the third quarter of 2023, potentially signaling increased trust and offering a potential precedent for SME’s.

Keep Your Crown Jewels

Collateral is an unwanted, but sometimes, obligatory condition in a loan agreement, serving as a form of security for lenders to mitigate the risk of default. In essence, collateral is an asset or assets pledged by the borrower to the lender, which the lender can seize and sell in the event of non-payment. The type of collateral accepted can vary depending on the lender’s policies, the nature of the loan, and the financial strength of the borrower.

Collateral can take various forms:

- Real Estate: Property owned by the business, such as land, buildings, or commercial premises.

- Equipment and Machinery: Tangible assets such as machinery, vehicles, or specialized equipment.

- Inventory: For businesses with substantial inventory holdings, such as retailers or wholesalers.

- Accounts Receivable: Outstanding invoices owed to the business by customers.

- Intellectual Property: Intellectual property assets, such as patents, trademarks, or copyrights.

It is a misunderstanding that, when presented with a loan agreement, collateral is not negiotable. Real Estate is a common example of collateral, but the devil is in the details. How much are you going to loan, and do you know the value of your property? Why give a property with a value of one million euro as collateral if you only intend to loan sevenhundred thousand euros. And should there be troubles in the future, how fast can the bank call upon it’s collateral?

*CFO-tip*: Negotiate with the bank for a cap on the value of your property, for example €500k for a loan of €700k. And secure a certain period of time that allows you to sell your property first.

It’s essential for small business owners and start-ups to carefully evaluate their available collateral and understand the implications of pledging assets to secure a loan. By leveraging collateral effectively, businesses can increase their chances of accessing financing at favourable terms while minimising the lender’s risk. However, borrowers should also be aware of the potential consequences of default, including the loss of pledged assets. Collaborating with financial advisors and legal experts can help businesses navigate the collateralisation process and make informed decisions that align with their long-term growth objectives.

Summary Collateral Data

Collateral significantly impacts businesses of all sizes. Since mid-2019, there has been a noticeable trend among banks demanding more collateral. Following the 2008 crisis, collateral requirements tightened, particularly for SME’s. From 2015 to late 2018, there was a general easing of these requirements. However, recent economic trends indicate a resurgence in the demand for collateral.

It is worth noting that tightening and easing of clauses like covenants and collateral follow roughly the general trend of the interest rates, with more tightening when interest rates are high and easing when they are low.

Europe Sets the Tone

Euro area banks tightened credit standards for loans to enterprises in Q4 2023, adding to cumulative tightening since 2022 and contributing to weak loan growth. This tightening, mainly driven by German and smaller euro area banks, moderated compared to the previous quarter and was below historical averages. Risk perceptions continued to tighten credit standards, while factors like banks’ cost of funds and competition had a neutral effect. Weak economic conditions and credit risks for firms were cited as main reasons for the tightening impact. However, banks’ own financial situations and market financing costs did not contribute to further tightening, with some banks even reporting an easing impact on market financing access.

At times, Belgian banks show modest independence and do things differently compared to other European banks. But most of the time, they go along with the general flow. Once in a while, though, they go in the opposite direction.

Note: the length of the bars are irrelevant. The European data represents weighted Net Percentages, where the Belgian data is isolated for the Belgian market.

CFO-tips for Successful Loan Application

In addition to understanding the nuances of loan terms such as covenants and collateral, SME’s and start-ups must also grasp the intricate process of applying for loans. While the financial assistance provided by banks can fuel growth and expansion, the journey to securing a loan can be daunting, especially for those new to the entrepreneurial landscape.

1. Preparation is Key: Before embarking on the loan application journey, it’s crucial that you meticulously prepare your documentation. Banks typically require a range of financial statements, business plans, cash flow projections, and personal guarantees. Ensuring these documents are accurate, up-to-date, and professionally presented can significantly enhance the chances of loan approval.

2. Explore Alternative Funding: While traditional banks remain a common source of business financing, SME’s and start-ups can also explore alternative lending options. Fintech companies, peer-to-peer lending platforms, and community development financial institutions (CDFIs) offer alternative avenues for accessing capital, often with more flexible eligibility criteria and faster approval processes.

3. Build Strong Relationships: Establishing and nurturing relationships with financial institutions can be invaluable for your business when seeking loans. By cultivating connections with bankers, financial advisors, and industry experts, businesses can gain insights into available financing options, receive guidance on loan application processes, and potentially secure more favourable terms. Regularly keep your bank informed on how the business is going, by sending them interim results. They’re likely to return the favour when times are more turbulent.

4. Demonstrate Growth and Knowledge: When presenting a loan application, you should emphasise your growth potential and market viability. Banks are more likely to support businesses with clear growth strategies, sustainable revenue streams, and a solid understanding of their target market. Highlighting past achievements, future projections, and competitive advantages can instill confidence in lenders and strengthen loan applications.

5. Seek Professional Guidance: Navigating the complexities of loan applications can be overwhelming, especially for those with limited financial expertise. Seeking guidance from financial advisors can provide invaluable support throughout the loan application process. Professionals can offer insights into financial management, assist with loan documentation, and help businesses make informed decisions aligned with their long-term objectives.

Conclusion

In conclusion, understanding loan agreements in the Belgian financial landscape requires a nuanced understanding of covenants and collateral. Recent trends show a tightening of requirements by Belgian banks since mid-2019, influenced by economic factors. To succeed in securing favourable terms, businesses should prepare meticulously, build strong relationships with financial institutions, and demonstrate potential. These strategies can enhance the chances of accessing financing and driving sustainable growth. Seeking professional guidance will help your business overcome these obstacles.

In this article we highlighted covenants and collateral. At CFOrent we specialize in acquiring loans for our clients while assisting them with the financial side of their business. Our starting point is always understanding your business and using our expertise in preparing your statements or searching for beneficial factors that’ll help convince the bank to give your business agreeable loan terms and conditions. You can find our contact form here.