Running a consultancy business is a dynamic juggling act. Success in this industry hinges on effectively balancing these two critical tasks. On the one hand, you’re tasked with delivering high-quality services to your clients, while on the other, you’re constantly on the lookout for new opportunities. To do this effectively, it’s crucial to understand and manage your billability.

The Foundation: Defining Billability

Before we delve into the intricacies of managing billability, let’s start with a fundamental question: What exactly is billability? In the world of consultancy, billability is typically defined as the percentage of time consultants spend on chargeable (client) work relative to their total working hours (excluding holidays and illness). However, the way of calculating billability can vary slightly from firm to firm. It’s important to have a clear definition of billability that is aligned across your organization so that everyone is working towards the same goals and that the billability rate is calculated consistently. Regularly reviewing the team’s billability and discussing the calculation method is a must to track team performance and ensure alignment within the management team.

Why Is Billability So Important?

There are three main reasons why billability is so important for consultancy firms:

- Balancing act: Consultancy firms must simultaneously deliver client work and seek new opportunities. Billability is the linchpin that ensures you’re not overloading your team with projects or leaving them idle.

- Resource optimization: Your employees are your most valuable asset. Billability helps you make the most of their time and expertise, ensuring you get the best return on your staffing investments.

- Profitability: Billability directly affects your bottom line. Maximizing billable hours means maximizing revenue, which is essential for business growth and sustainability.

The CFO’s Perspective

From the CFO’s perspective, billability is a critical metric that helps to measure the financial health of the consultancy firm. To track billability, the CFO will need to collect data on the number of billable hours worked by consultants, as well as the number of non-billable hours. This data can be collected through time tracking software, such as Clockify or Harvest.

The target billability rate will vary depending on the firm’s specific circumstances. The ideal billability rate for your firm will depend on a number of factors, such as the industry you serve, the type of services you offer, and the level of experience of your consultants. More complex businesses (with often a higher day rate) usually have a lower billability. On a global average, it generally hovers around 70-75%.

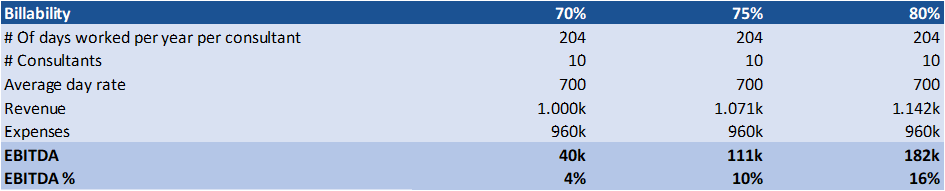

Billability directly impacts your bottom line. A higher billability rate can significantly boost your EBITDA. For instance, with an average billability of 60%, a company can achieve on average an EBITDA of 3-5%. In contrast, an average billability of +80% can lead to an EBITDA of +10%. Therefore, excelling in billability not only boosts your revenue but also your profitability. In the example below, you can see that an increase of 10% in billability increases the EBITDA from 4% to 16%, a four-fold increase.

Also for budgeting and forecasting exercises, billability becomes one of the leading metrics. The total hours performed multiplied by the billability rate and the day rate will determine your company’s revenue. Since billability directly affects your bottom line, overshooting billability can lead to increased profitability and a healthier cash flow. Conversely, falling short on billability can lead to decreased profitability and reduced cash inflow.

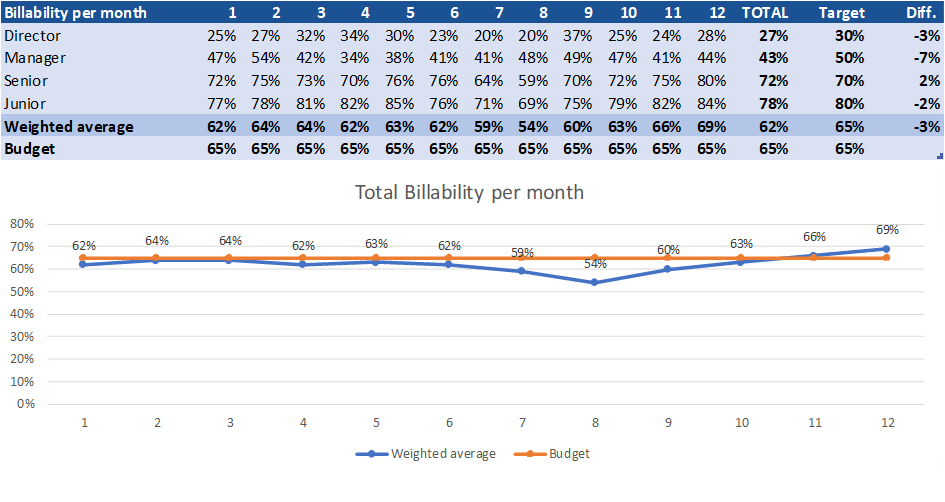

Therefore, tracking this metric is very important. During the budget process, set target billabilities per level and on a company level. Using a simple table and graph, you can provide management with an overview on a monthly basis. In the example below, you can immediately see that the company slightly underperforms in terms of billability. Important note: use weighted averages, as there will be fewer directors and managers in the team than seniors and juniors, so the billability of the juniors and seniors should carry more weight in the calculation.

Strategies to Improve Billability

There are a number of strategies that consultancy firms can use to improve their billability. These include:

- Effective time management: Consultants must efficiently allocate their time to maximize billable hours. Time tracking tools can help identify non-billable activities that can be minimized.

- Project scoping and planning: Accurate scoping and project planning are essential to avoid scope creep and ensure that fixed fee projects remain profitable.

- Regular client communication: Maintaining open and honest communication with clients helps manage expectations and address any concerns promptly.

- Training and skill development: Ongoing training and skill development can increase a consultant’s efficiency, allowing them to complete tasks more quickly while maintaining quality.

Common Pitfalls to Avoid

There are a few common pitfalls that consultancy firms should avoid when trying to improve their billability. These include:

- Overcommitting: Taking on too many projects can lead to burnout, reduced quality of work, and missed deadlines. It’s crucial to assess your firm’s capacity realistically.

- Underestimating non-billable time: Administrative tasks, meetings, and internal training are non-billable but essential. Don’t overlook these when calculating billability.

- Ignoring client communication: Effective customer communication is key. Regular updates, setting clear expectations, and maintaining a strong client relationship contribute to better billability.

Conclusion

In the fast-paced world of consultancy, mastering billability is the key to success. It’s not just about delivering excellent service but also about managing your resources effectively to maximize profitability and cash. By defining billability, setting realistic targets, and avoiding common pitfalls, your consultancy business can thrive and continue to provide exceptional value to your clients.

Remember, billability is more than just a metric; it’s a strategic tool that can propel your consultancy firm towards sustained growth and excellence.

CFOrent, your strategic partner in realizing growth from a financial perspective. For more in-depth information and practical guidance on billability, contact us.