In the dynamic world of startup companies, the journey to success is sometimes marked by funding rounds, each impacting the ownership structure and, consequently, the distribution of returns. At the heart of this financial orchestration lies a critical component—the Cap Table, short for Capitalization Table. A Cap Table is a comprehensive ledger that outlines the equity ownership of a company and gives you insights on the changes in the ownership of the company. In this blog, we’re going to break down Cap Tables and talk about why they matter, alongside several concepts like valuation, dilution, non-dilution, and types of equity.

The Crucial Role of Cap Tables in Your Company’s Journey

A cap table is a ledger that outlines the equity ownership of a company. It provides a snapshot of who owns what and is an essential tool for both founders and investors. The cap table includes details such as founder shares, employee stock options, and various rounds of funding. As a startup progresses through funding rounds, the cap table evolves, reflecting changes in ownership stakes.

Keeping it up to date is crucial for founders and investors. For founders, it provides clarity on ownership distribution and supports decision-making in fundraising and equity allocation. Investors use it to assess returns and influence. An accurate cap table is essential for governance, decision-making, and financial planning, projecting dilution impact and aiding in strategic choices.

Exploring Valuation: Shaping the Future of Your Startup’s Success

Valuation is the process of determining the economic value of a company. It plays a pivotal role in shaping a startup’s destiny. A well-defined valuation not only attracts investors but also influences the terms of investment. Startup valuation methods can vary, with factors like revenue, market potential, EBITDA and comparable company analysis taken into account. A higher valuation typically implies a higher perceived value of the company but can also lead to greater dilution for existing shareholders in subsequent funding rounds.

Two commonly used methods in this realm are the Discounted Cash Flow (DCF) and multiples (on EBITDA or common in SaaS companies on ARR). For example:

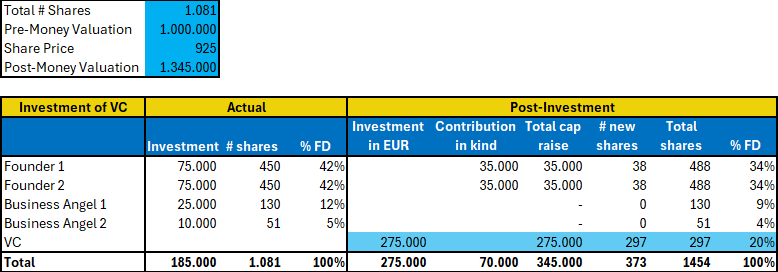

In the following example, you can observe a cap table of a company with 2 founders and 2 business angels. Under the ‘actual’ column, you can see the number of shares each party holds and the percentage of shares they have. In the seed round, a venture capitalist (VC) joins the company with a €275,000 investment at a valuation of €1,000,000. As there are already 1,081 shares in circulation, this results in a per-share price of €925 at this valuation. This investment leads to a shift in the ownership percentages.

The Dance of Dilution

Dilution often raises concerns for founders and early investors in the startup world. It happens when a company issues new shares, thereby reducing the ownership percentage of existing shareholders. While dilution is an inherent part of fundraising through subsequent rounds, the real challenge lies in effectively managing it to ensure that the founding team and early investors maintain a fair share of the company’s success.

As founders secure more funding, their ownership stake naturally dilutes. The ideal scenario is for founders to target a dilution of 15-20% per funding round, with the aim of retaining 50-60% ownership in the company by the time they close a Series A round. This strategic approach is crucial as it helps founders strike a balance between securing necessary capital and safeguarding their control over the startup.

Failure to manage dilution within these suggested ranges could result in founders losing significant control over their startup, inviting potential concerns from venture capitalists during the fundraising process. Striking the right balance in ownership percentages is not only a financial consideration but also a strategic move to ensure founders maintain influence and direction over the trajectory of their company. It’s a delicate dance that founders must master to steer their startup towards success without compromising their vision or control.

Safeguarding Ownership: Non-Dilution

Non-dilution, or anti-dilution provisions, act as a shield for early investors, specifically designed to prevent the dilution of an investor’s ownership stake. These provisions come into play during a down round, where a company secures funding at a lower valuation than its previous round, helping to maintain the relative ownership percentages of existing investors.

Investors typically incorporate anti-dilution clauses into agreements, such as a Shareholders’ Agreement (SHA) or an equity issuance contract, to safeguard against dilution. The two primary types of anti-dilution mechanisms are Full Ratchet and Weighted Average.

- Full Ratchet: Preserves the investor’s ownership percentage, irrespective of the price at which new shares are issued.

Example: If an investor holds 10%, and the company issues new shares, a Full Ratchet clause ensures the investor receives additional shares to maintain their 10% ownership without having to purchase the new shares.

- Weighted Average: Safeguards the investor’s stake by considering both the number and price of newly issued shares.

Example: Assuming an investor holds 10%, and the company issues new shares at a lower price, the Weighted Average clause grants the investor additional shares based on a formula, mitigating the dilution impact.

Types of Shares: Common Equity, Preferred Equity, Shared Warrants, and Convertible Equity

Equity Classes: Common vs. Preferred Equity

Cap Tables neatly categorize equity into two main classes —Common and Preferred. Common Equity represents ownership held by common shareholders, including founders and employees. On the other hand, Preferred Equity is typically held by investors and comes with certain privileges, such as priority in liquidation proceeds and anti-dilution protection.

Equity holders typically possess voting rights, allowing them to participate in important decisions affecting the company. This is a key aspect of corporate governance, ensuring that those with a stake in the company have a say in its direction. Preferred Equity holders, however, might not always have the same voting power. The distribution of voting rights is an additional layer of nuance in the complex world of equity classes and ownership structures.

Adding Complexity: Shared Warrants

Warrants are financial instruments that provide the holder with the right to purchase shares at a predetermined price. Shared Warrants are agreements that allow multiple parties to benefit from the same set of warrants. These can be used to incentivize different stakeholders, aligning their interests with the company’s success.

Flexibility in Fundraising: Convertible Equity

Convertible equity is a unique financial instrument that combines elements of both equity and debt. Unlike traditional equity investments, where investors purchase shares in a company at a fixed price, convertible equity starts as a debt instrument with the option to convert into equity at a later stage. This hybrid nature provides a degree of flexibility for both investors and startups. For this reason, convertible equity is a commonly used tool by incubators.

However, this adaptability introduces a degree of complexity, given that each convertible loan can vary, contingent on the included clauses. An example of a common used clause is a liquidation preference, let me explain by using an example:

- Investment: You invest €100,000 with a 1x liquidation preference.

- Exit Event: The company is sold for €500,000.

- Outcome:

- Without Liquidation Preference: In a scenario without liquidation preference, all proceeds would be divided among shareholders based on their ownership percentage. If, for instance, you own 10%, you’d receive €50,000 (10% of €500,000).

- With 1x Liquidation Preference: With the 1x liquidation preference, you receive your initial €100,000 back first. The remaining €400,000 is then distributed among the shareholders based on their ownership percentages. In this case, you’d receive an additional €40,000 (10% of €400,000), bringing your total to €140,000.

Liquidation preference helps investors feel more secure about getting at least their invested capital back, especially in situations where the company is sold for a lower value than anticipated.

CFO tip: When making a convertible loan agreement, get help and make sure you understand all the parts. Get a knowledgeable advisor, carefully read and understand your term sheet—everything can be negociated. Don’t give away too much; it might cause problems later. Be careful and don’t seem too desperate for money. Your smart choices now can really affect your financial future.

Navigate Startup Success with Your Financial Guidebook

In the world of startup money, think of a well-organized Cap Table like a clear guidebook. It shows who owns what in the company and is super useful for founders, investors, and others involved. Knowing stuff like how the company is valued, dilution, and different types of equity is crucial for steering the startup in the right direction. As the startup grows, the Cap Table changes with new funding and partnerships. Understanding these money details helps entrepreneurs steer their businesses well for lasting success.