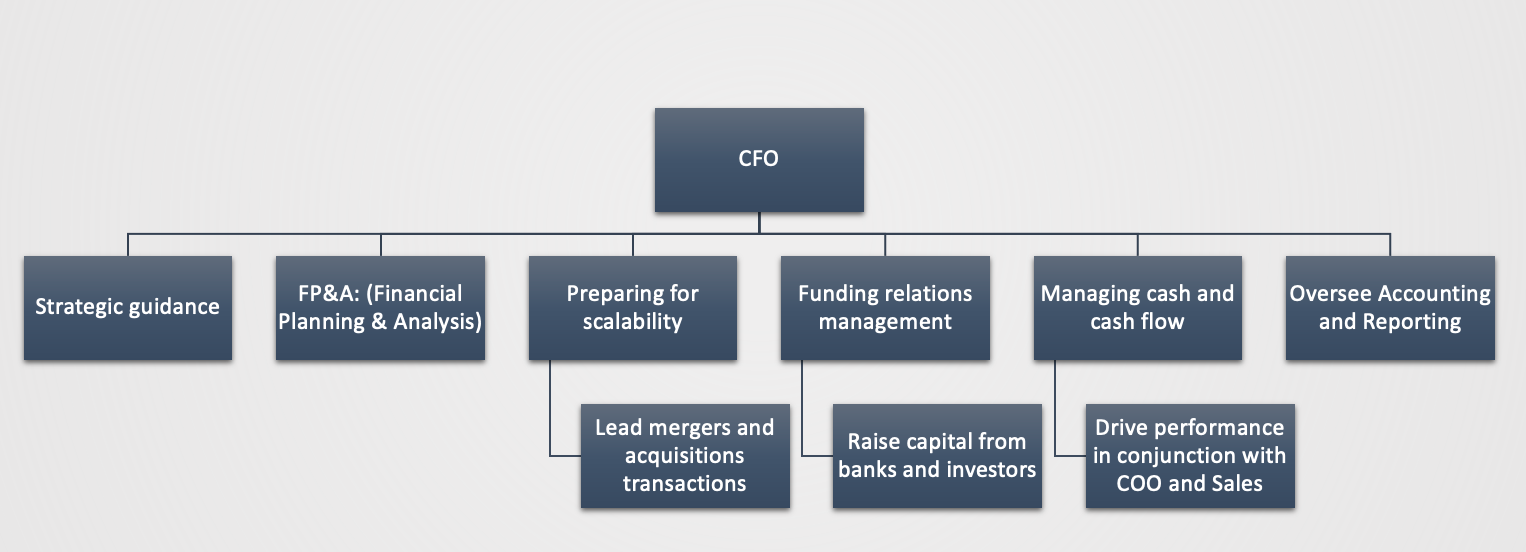

What impact can a Chief Financial Officer (CFO) have for the company? And why do companies need one? This blog answers these questions.

The Chief Financial Officer plays an integral role in a company’s growth and financial well-being; however, what tasks do they perform to achieve this? In this blog, we discuss some of the primary activities in which the CFO is engaged.

A CFO is responsible for planning, directing, and leading all financial activities of the organization. They are in charge of making sure the company’s financial goals are met and that the company is operating in a financially sound manner.

Strategic guidance

When growing a business it can be difficult to maintain a sharp focus on where to speed up or slow down. Especially for businesses in early to scaleup stages, the allocation of resources (money / skills / people / …) can be a success-maker or -breaker. Having someone who can challenge the management team (often CEO, COO, CMO, combined in several roles) and act as a sparring partner can give the necessary strategic guidance to set the company on the course of succes.

Strategic guidance is a form of leadership that helps organizations align their goals, objectives, and strategies to achieve a desired outcome. It involves setting priorities, formulating plans, and monitoring and evaluating progress over time. Strategic guidance is important for organizations to remain competitive, focused, and lean. It helps them to identify areas of improvement, capitalize on opportunities, and focus resources on the most important objectives.

FP&A: (Financial Planning & Analysis)

The Chief Financial Officer (CFO) of an organization plays a key role in the Financial Planning & Analysis (P&A) process. The CFO is responsible for setting clear financial goals, overseeing the budgeting and forecasting process, monitoring key performance indicators (KPIs), and managing the organization’s cash flow. The CFO is also responsible for ensuring that all financial reporting is accurate and timely. The CFO is ultimately responsible for setting the tone of financial strategy, and ensuring that it is properly executed.

Preparing for scalability

CFOs are responsible for the overall financial health of the organization, including setting financial strategies and overseeing the financial operations of the business. With scalability and global expansion, CFOs must be involved to ensure the organization is able to manage the financial implications. This includes evaluating the costs associated with expansion, assessing the organization’s creditworthiness with external lenders, forecasting capital needs, preparing budgets, and managing tax and compliance risks. Additionally, CFOs are responsible for implementing processes and systems to ensure efficient financial operations, such as implementing ERP systems, creating links between financial and operational insights, and setting up foreign entities for global expansion. By taking a proactive role in the financial operations, CFOs can ensure the organization is financially prepared for growth.

Funding relations management

CFOs are responsible for ensuring that their companies have the financial resources needed to operate. They are involved in investor, bank, and funding relations management in order to ensure their companies have the capital needed to succeed. CFOs are involved in raising capital from banks and investors, which may involve searching for new capital sources or preparing for and completing an M&A track, especially during difficult economic times. CFOs must stay abreast of the latest financial trends in order to make sound decisions that will help their companies achieve their financial goals.

Managing cash and cash flow

The Chief Financial Officer (CFO) is responsible for managing the company’s cash and cash flow. This includes ensuring that sufficient cash is available to meet the company’s obligations, as well as monitoring cash inflows and outflows to ensure that the company is able to meet its financial obligations. The CFO also oversees the development of short-term and long-term financial strategies and plans to secure the company’s financial position and future.

Raise capital from banks and investors

The Chief Financial Officer (CFO) is typically responsible for raising capital from banks and investors. The CFO will work closely with the company’s executives and board of directors to develop the right strategy for raising the necessary capital. This includes creating financial projections and models, negotiating financing terms, and securing the necessary funds. The CFO will also be responsible for ensuring that the capital raised is used in the most efficient manner.

Drive performance in conjunction with COO and Sales

CFOs are responsible for the financial management of an organization and are involved in setting priorities and managing the finances of the organization. In a situation such as this, the CFO would be involved in helping the COO and Sales team to drive performance by providing guidance on financial matters such as budgeting, forecasting, and investment decisions. The CFO would also be responsible for monitoring the performance of the organization and providing feedback to the COO and Sales team in order to ensure that they are meeting the organization’s financial goals.

Oversee Accounting and Reporting

The Chief Financial Officer (CFO) is responsible for overseeing the accounting and reporting of a company. This includes ensuring accurate and timely financial record-keeping, timely and accurate financial reporting to the board of directors and external stakeholders, and the compliance with all applicable financial laws and regulations. The CFO is also responsible for developing and managing the budget, managing cash flow, and developing strategies to maximize returns on investments. Additionally, the CFO is responsible for managing the financial risks of the organization and providing guidance to business units on financial matters.

Lead mergers and acquisitions transactions

The Chief Financial Officer (CFO) plays a major role in mergers and acquisitions (M&A) transactions. The CFO is responsible for leading the financial due diligence process, negotiating financial terms, and providing the right financial structure to complete the deal. The CFO is also responsible for understanding the tax implications of any transaction, ensuring compliance with regulatory bodies, and monitoring all financial risk associated with the transaction. In addition, the CFO is also responsible for evaluating the financial performance of the target company and making sure the acquisition is in line with the company’s overall strategic goals.

Conclusion

Being a catalyst for growth, having a CFO is essential for any business. They are invaluable for planning and decision making, managing cash flow, and compliance and risk management. Additionally, they can help a company to improve its financial performance and secure financing. For any business, having a CFO who thinks with you about the future, can have a significant impact.