One of the most critical questions that startup founders face is how much money they should raise for their company. The answer is not as simple as a one-size-fits-all solution, as it depends on various factors specific to each company, such as its industry, growth potential, and business model.

However, raising too much money can be just as detrimental as not raising enough. The current economic sentiment has largely shifted in recent months. Valuations have plumeted and investors aren’t looking for shiny new tech companies, but rather for solid business who have the foundations to survive in difficult times. The recent saying “Date a unicorn, marry a donkey” is an illustration that times can change. Profitability is key again and the investor will want to see this path to profitability. Here are some key factors to consider when determining how much money to raise:

Raising Capital to fund your Company

Raising money shouldn’t be the goal.

Allow us to rephrase it, don’t raise money unless you have to. There are no real ‘wrong’ reasons to attract an investor if you’re looking to grow your company, but there a couple of ‘not-so-right’ reasons. So, when looking at the option of attracting investors, make sure it’s for the right reasons.

Entrepreneurs should be aware that raising too much capital in the early rounds can result in a down round, where the company raises capital at a lower valuation than the last round of funding. This often happens when a company is having difficulty meeting its financial goals and needs a cash infusion to stay afloat. It is important to measure success in terms of more than just the amount of money raised or the valuation that such a funding round reflects. Instead, entrepreneurs should aim to raise enough capital to reach their next valuation milestone, as this will allow them to raise funds at a higher valuation in the future. By doing so, they can avoid the risk of a down round, which can be seen as a sign of distress and a warning sign for investors.

An example where both companies haven’t attracted any previous funding.

Company A is raising 1 million. They are in the phase of developing the MVP (minimum viable product), are burning 50k per month and have 5 employees. The first product still needs to be sold.

Because of the potential and early stage character, investors currently value the company at 2 million.

Company B is raising 1 million. A well established scale-up with a monthly recurring revenue of 250k, currently employing 45 people, monthly burning at a rate of 250k. They’re looking for investment to scale their sales team, hire a COO profile and accelerate their growth through launching via a new channel. The company is currently valued at 9 million.

The difference is that founders of company A give away 33% for the 1 million investment, while the founders of company B give away only 10% of their company.

It can make all the difference to raise a lower amount, while reaching profitability upon which a higher valuation round can be raised, and a bigger piece of the pie can remain with the founders. Which eventually may come in very useful when raising for any future rounds if necessary.

Giving away a big stake by raising to much at an early stage can potentially mean a devastating low return for the founders on the long-term.

The Resources needed for Fundraising

Raising asks a significant amount of resources, which can be put to other use if not aimed at the fundraising process.

- Think about the amount for legal and financial advisory or the vast amount of valuable time of the founder, which can’t focus on the business while preparing the fundraise or while talking to investors.

- The entire organization will be impacted by the time, efforts and energy-drawing volatility that goes with fundraising, from dataroom preparation to talking to investors, to negotiating and getting administration in order. Sales, Operations, Admin, HR, every department will be involved.

- Once you have investors on board, reporting, governance, strategy and aligning all stake- and shareholders will be even more challenging. The attention required to maintain solid relationships with your investors is not to be underestimated. From monthly updates to preparing board meetings, or simply handling specific requests.

It is therefore smart to consider the opportunity cost of growing at a slower pace and putting the resources (human and monetary) in growing the business instead of raising capital.

Critical elements for determining the amount to raise

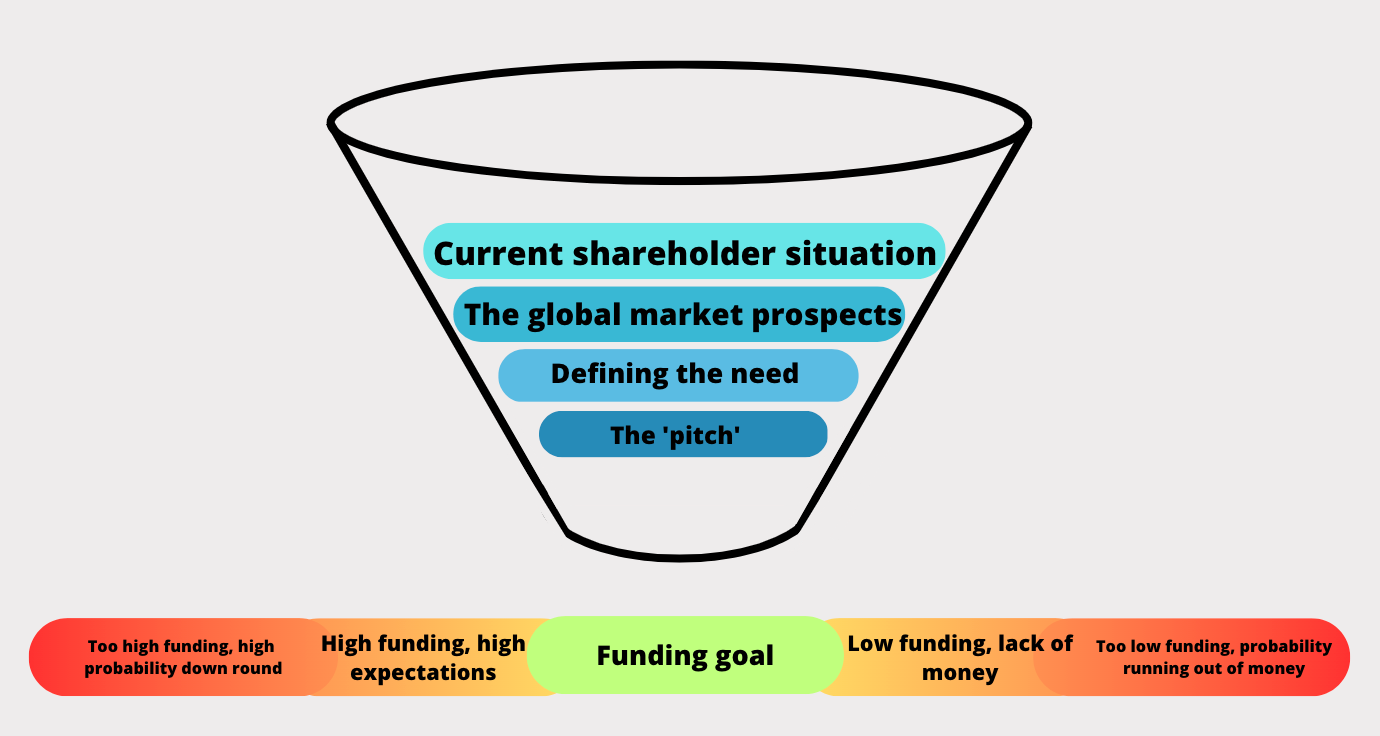

1. Defining the need

Before seeking funds, you need to understand why you need it and how the money will be used. The amount of money you raise should reflect your company’s growth potential. A startup with a high growth potential will require more capital to achieve its goals than a startup with lower growth potential. However, raising a high amount does create high expectations. Consider whether it is absolutely necessary to raise funds or if it is possible to reach your goals without them. To gain clarity on your financing needs, it is essential to have a detailed view of your financials and strategy. With a clear understanding of what you want to achieve, you can determine if the money should be spent on production processes, marketing, market establishment, or innovation.

2. Current shareholder situation

It is essential to review the current cap table and secure agreement from all current shareholders, including founders. When planning for fundraising, it is prudent to consider multiple scenarios with varying amounts raised and valuations of the company. Too much money raised can have a detrimental effect on the company, just as not enough money can. Therefore, it is critical to raise the right amount of money while maintaining as much equity as possible. To have a good understanding the burn rate is an important metric. Your burn rate is the rate at which you are spending money before generating revenue. You should aim to raise enough money to keep your company afloat for at least 18 months, but not so much that you become complacent with your spending. Using the right financial metrics are important to help gather the needed information to determine how much funding is needed.This will ensure that there is potential for a future round of fundraising, if necessary.

3. The global market prospects

Raising capital during a difficult economic period can be challenging, but it is still possible to find investors who are willing to invest in a good project. While it may be more expensive and require more effort than usual, the long-term benefits of surviving another year with a lower growth scenario while focusing on achieving profitability may be worth it. Additionally, it is important to be aware that lower deal flow and valuations are common during these times and raising a large amount of capital may not be the most beneficial strategy.

4. The ‘pitch’

The value proposition of our company is that we are selling a product or service that has potential for growth and profitability. By providing investors with a realistic financial plan and growth projections, we can ensure that they understand the risks and potential returns associated with their investments. We can also demonstrate the potential of our business model by showing how our revenue streams and costs can support our goals. By setting a realistic fundraising goal, companies provide investors with an accurate estimate of the return on their investment. Ultimately, the goal is to create a compelling value proposition for investors that will motivate them to invest in the project.The company on the other hand should also understand the business and financial plan to know how much funding is needed.

Conclusion

Conclusion

In conclusion, raising too much money can be just as detrimental as not raising enough. It’s essential to consider factors such as valuation, burn rate, growth potential, and business model when determining how much money to raise. By doing so, you’ll be able to raise enough capital to achieve your goals without compromising the future success of your company.

Read more about it in our alternative funding blog!

CFORENT ADVICE

Don’t raise to raise; look at the cash need and build in some contingency to, raise for a period of 18 months at least, as it takes 6 m to prepare well (minimum), don’t focus solely on valuation, but be aware of all the terms and use your financing mix to increaes the amount if needed.

FUNFACT

In the famous sitcom Silicon Valley the main characters were also having trouble finding out how much to raise, they opted not to take the higher offer from the venture capital firm because they felt the terms of the offer were too restrictive. The firm wanted control over the company, which would have limited the freedom and autonomy of the main characters. They felt that the lower offer from another firm was the better option because it gave them the freedom to make their own decisions about their company.