What you need to know about net working capital and its importance for your company

This article is part 3 of the metrics mini-serie on financial metrics.

Managing your cash inflows and outflows, is vital for all companies whether they have expansion or re-organization plans. A large amount of cash can be taken up by the working capital. You may need to give your clients decent payment terms, maintain a certain inventory to service clients, and pay your suppliers in a timely manner. However, it is not always straightforward to manage those cashflows efficiently.

Let’s take a look at the net working capital in more detail.

Net working capital (NWC)

NWC measures a company’s liquidity, operational efficiency, and short-term financial health, providing an insight into the company’s overall liquidity and its ability to pay its short-term debts. (For more information on other liquidity metrics, read our previous blog on liquidity.)

A positive NWC indicates that a company can finance its current operations and invest in future operations and growth, while a negative NWC shows that the current ratio is less than 1 (see our liquidity blog), which means the company may have difficulty growing or paying back creditors.

However, a high NWC is not always positive as it can indicate that the company has too much stock or is not investing its excess cash. To avoid this, it’s important to monitor and manage your NWC carefully, but depending on your industry sector, this can be capital-intensive to do.

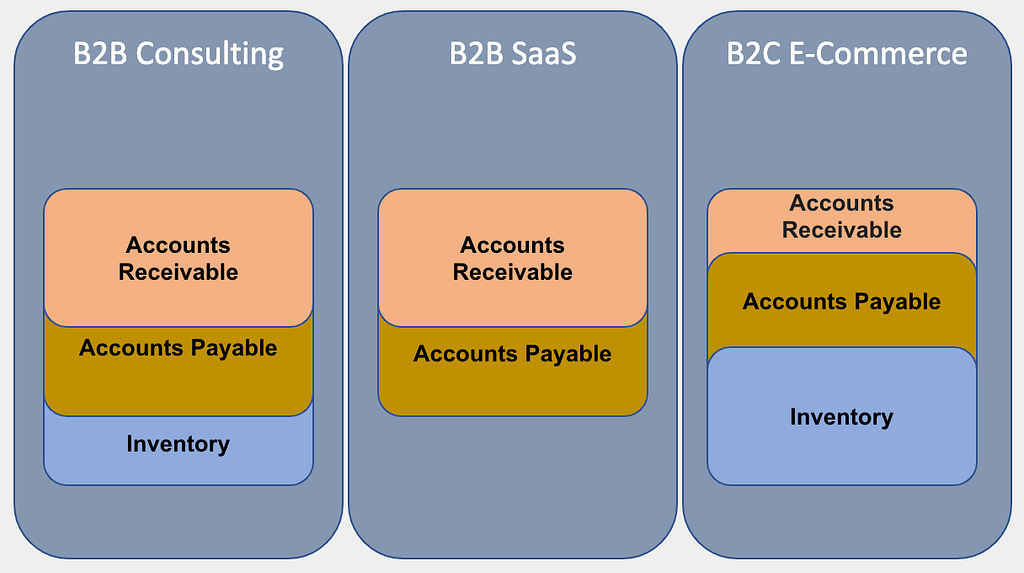

Every sector is different, and the relevance and importance of NWC on your company depends on various factors.

An important factor is the average deal size. Businesses with larger deal sizes tend to give longer payment terms or refer to periodic invoicing for collecting cash. This is often the case for a consultancy business or B2B SaaS business. While resources (service of employees) are provided and payment by clients will be performed afterwards, this can lead to a temporary cash need, or phrased differently, a working capital need.

It is less relevant for sectors with a small deal size, such as B2C e-commerce companies, because payment often happens immediately.

For a B2C SaaS business, giving the customer the option to pay 12 months upfront, can be a powerful way to create a positive effect on the cash balance.

How to calculate your NWC:

current assets – current liabilities (broad definition)

accounts receivable + inventory – accounts payable (narrow definition)

Important elements for calculating NWC

- Accounts receivable: this can be measured using the days sales outstanding (DSO) metric.

- Inventory: this can be measured using the days sales of inventory (DSI) metric which is also known as the days inventory outstanding (DIO) metric. Alternatively, this can be done by counting the number of products in inventory using price-volume metrics. In order to use these metrics, your inventory must be clear and identifiable. Inventory is only included in the NWC for product-related companies.

- Accounts payable: similarly, this can be measured using the days payables outstanding (DSO) metric. This metric should be monitored closely to ensure you pay invoices on time, but not too early or late, to optimize your cashflows.

More information on all these metrics can be found in our liquidity blog .

Three aspects of NWC are working capital requirement (WCR), cash burn, and cash runway.

- Working capital requirement (WCR)

WCR is the amount of money required to keep the company’s operations going (or expanding) by covering the gap between accounts receivable, accounts payable and inventory. The larger this gap is, the less flexibility and capital you have available to seize opportunities, such as expanding your product line to meet new demand. When calculating your WCR, it is important to plan for late payments from some customers to ensure that your WCR is realistic.

The efficiency of your working capital can be calculated using the cash conversion cycle (CCC) metric (see our liquidity blog).

- Cash burn

The cash burn rate looks at the amount of money a company spends per month, in other words, it measures the negative cashflow. There are two variations of cash burn: net burn and gross burn. Gross burn is the total amount of expenditure the company has per month, while net burn also includes revenues.

When you are growing a company from scratch it is likely that it is not profitable for a significant period of time. To prepare for investments planning, and importantly manage the cash need, the cash burn is most relevant.

How to calculate your net cash burn:

Revenue – monthly operating expenses = net burn rate

Cash/monthly operating expenses = gross burn rate

- Cash runway

The cash runway calculates how long the company can continue to operate at the current cash burn rate before they run out cash reserves and would need to raise additional capital. It can be used to highlight potential overspending, for example if the cash runway shrinks from one quarter to the next. Together with the cash burn rate, the cash runway is especially useful to track growth and profitability in startups.

How to calculate your cash runway in months:

Total cash/monthly cash burn rate (gross or net)

Talk to the experts

Are you interested in better managing and optimizing your NWC to achieve your company’s future ambitions? Do you want to talk about your WCR, cash burn rate or cash runway? Contact CFO rent for expert help on boosting your company’s financial health by improving your cashflows.

This is the third article in a four-part blog series on metrics in financial metrics. Click here to read part 1 on profitability, part 2 on liquidity and part 4 on solvability.